Large SUVs : Because of their large size and capacity for more passengers, these vehicles often cause more damage and injuries during accidents.Here are a few types of vehicles that tend to be more expensive to insure: The cost of replacement parts and repairs, the likelihood of accidents and the vehicle’s safety features all contribute to how much you pay for auto coverage. The type of vehicle you drive plays a key role in setting your car insurance rates. Comprehensive coverage protects your car against damage from natural disasters, theft, fire and vandalism. Collision coverage pays for damage to your vehicle no matter who causes an accident. It’s required in most states and covers other drivers’ injuries and vehicle damage when you cause an accident.įull-coverage car insurance goes beyond state-minimum coverage by adding collision and comprehensive coverage to liability protection. Liability insurance has two components: bodily injury and property damage. There are good reasons for the wide price difference between full-coverage car insurance and minimum-liability coverage.

#Compare auto insurance rates by state driver

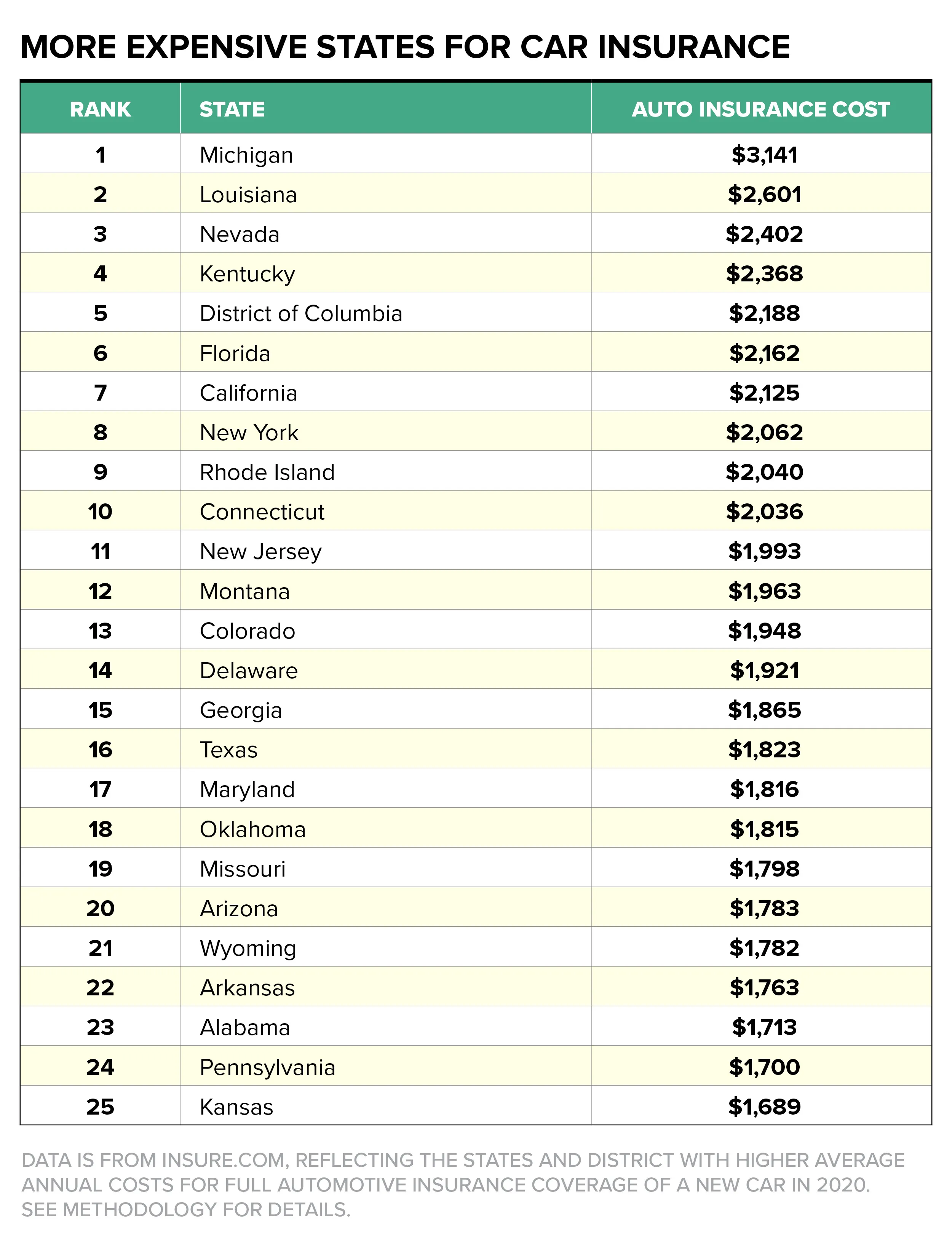

This is because insurers consider factors like your location, driver profile, vehicle and desired coverage when calculating premiums. However, what you pay for auto insurance coverage varies based on your personal rating factors. The average cost of full-coverage insurance is $2,008 per year or $167 per month, while minimum-liability coverage averages $627 per year or $52 per month.

0 kommentar(er)

0 kommentar(er)